Good morning. Many investing mistakes happen after the hard work is already done. A decision is made for sensible reasons. Time passes. Progress feels slow. Doubt begins to creep in. What often follows is an unnecessary change.

Fun fact: Did you know the term “blue-chip stocks” comes from poker? In 1923, a Dow Jones employee named high-priced, high-quality stocks after the blue poker chips, which carried the highest value at the table. Similarly, blue-chip companies are generally the most established, high-quality businesses in the market.

One of the most useful skills an investor can develop is knowing when to leave things alone.

This skill rarely gets attention because it doesn’t look like effort. There’s no visible action involved. Nothing appears to change for long stretches.

When you own a business, most days look ordinary. The company continues operating. Customers keep buying. Management focuses on decisions whose effects won’t be obvious for some time. From the outside, there’s very little to react to.

That quiet period is where many investors struggle.

People want feedback. They want reassurance that a decision was correct. When information slows down, or prices move without a clear reason, it becomes tempting to revisit decisions that were made with care.

Strong businesses don’t provide constant updates. Their progress is gradual. Improvements show up unevenly, and much of the work happens away from public view.

If an investing process depends on frequent reassurance, it becomes harder to follow over time. Normal periods without news start to feel uncomfortable. Small price movements begin to matter more than business fundamentals. Eventually, the desire for certainty leads to action that was never part of the original plan.

Long-term investing requires comfort with waiting.

That waiting often means holding positions through long stretches where nothing stands out. It means trusting prior reasoning while accepting that results take time to emerge.

Many investors respond to discomfort by staying busy. They review portfolios often. They make adjustments. They look for ways to “improve” results. Sometimes changes are necessary. Often, they aren’t.

Businesses that compound well tend to look uneventful once they’re owned. They move forward at their own pace — usually slower than expectations.

Charlie Munger once said that most of the money in investing is made by waiting. The idea is easy to understand. Practicing it consistently is much harder.

If you can hold a solid business through long periods without revisiting the decision every time things feel quiet, you’re applying a skill that supports better outcomes over time.

One way to support this mindset is to limit how often you evaluate your portfolio.

Setting a review schedule creates structure. Quarterly reviews work well for many investors. During those reviews, decisions can be evaluated with distance and context.

Between reviews, attention stays on understanding the business rather than reacting to short-term movement. This reduces unnecessary changes and helps keep decisions aligned with original reasoning.

Over time, this habit allows patience to become part of the process — not something you rely on emotionally in the moment.

Which of the following behaviors is most likely to erode long-term investing results, even when the original thesis was sound?

A) Chasing headline-driven trades

B) Selling high-quality businesses too early

C) Overreacting to short-term price noise

D) Over-diversifying into unfamiliar sectors

Answer below

PRESENTED BY THE WALL STREET DREAM

Investing is Our Business.

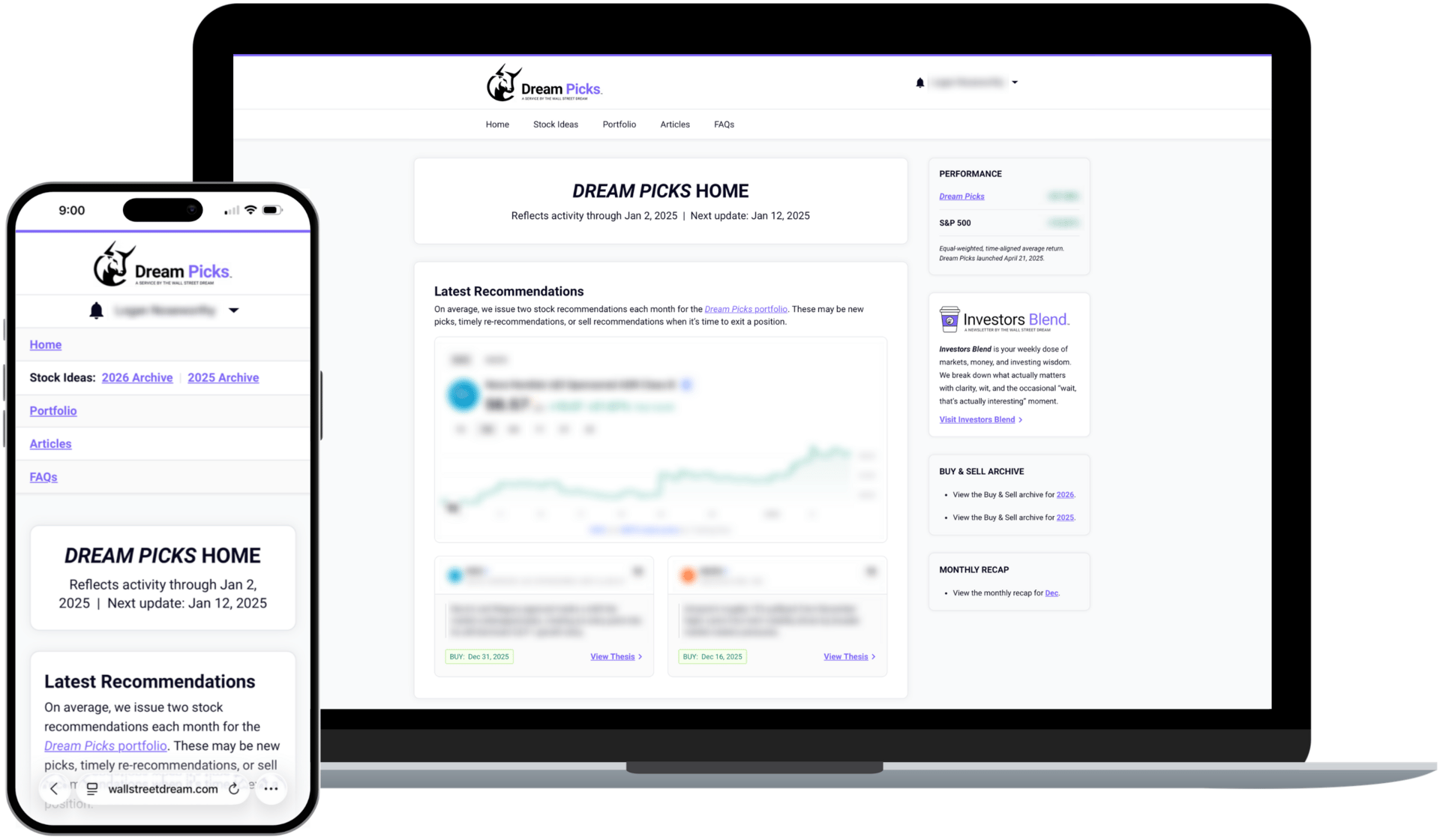

Dream Picks is Your Advantage.

Stop chasing headlines and start investing with confidence. Dream Picks delivers clear, research-backed stock recommendations to help individual investors like you save time, eliminate guesswork, and build long-term wealth. We cut through the noise to deliver actionable insights, along with ongoing coverage that empowers you to invest smarter, now and into the future.

What You Get As a Member:

📈 Monthly Stock Picks: Receive, on average, two high-conviction stock picks each month, each with a clear, actionable investment thesis you can follow confidently.

📚 Buy & Sell Archive: Explore all active and past stock recommendations — buy recs, re-recs, and sell recs — each with its original thesis so you can track performance and learn from every pick.

📩 Weekly Email Updates: Get a brief Monday-morning email showing updates in the Members Area and any new recommendations.

🔒 Exclusive Members' Area: Access all stock picks, investment theses, and performance tracking in one simple, easy-to-navigate members’ area.

Investing doesn’t require constant input.

Some decisions improve simply by being left alone. Learning when that applies is a skill that develops with experience and discipline.

See you next Monday.

Cheers,

☕️ The Investors Blend Team

Written by the Investors Blend team. AI tools were used to assist with editing and refinement, but all insights, perspectives, and opinions are entirely our own.

Answer

B) Selling high-quality businesses too early

Even well-researched decisions can be undermined by impatience, boredom, or the pressure to act.

Concept of the Week

Intervention Bias — the tendency to feel compelled to act simply because time has passed or uncertainty is uncomfortable, even when waiting or doing nothing would produce better outcomes.