Today is January 12, 2026 — and markets didn’t ease into the new year. Fresh highs, solid gains, and something investors haven’t seen much of lately showed up almost immediately: participation beyond the usual handful of names.

Hard to believe, but the S&P 500 just logged its strongest opening week of a year in three years, climbing about 1.6%. Even more notable, leadership began to spread beyond mega-cap tech — a subtle shift, but an important one.

(Any guesses what the last year was to start January this strong? We’ll circle back to that at the bottom — along with our Word and Wisdom of the Week.)

Taken together, the first full trading week of 2026 delivered a little of everything: record closes, early signs of rotation into cyclicals, and a geopolitical headline that markets digested without much fuss. Here’s what actually mattered — and why it’s worth paying attention.

MARKETS AT A GLANCE

*As of market close January 9, 2026.

S&P 500: up 1.57% for the week, finishing at record highs around 6,966.

Nasdaq Composite: up 1.88%, with rotation helping ease tech’s dominance.

Dow Jones Industrial Average: up 2.32%, logging fresh record closes.

All three major indexes finished the first full week of 2026 up more than 1.5%. Nine of the S&P 500’s 11 sectors ended the week higher, with value and cyclical stocks showing real signs of life — a classic signal that leadership may finally be broadening after years of narrow gains.

The week opened with a burst of energy tied to geopolitical headlines, cooled modestly mid-week, and wrapped up with a Friday rally that pushed markets back to new highs.

FEATURED STORY

When the Market Leadership Starts to Broaden

The early tone of 2026 suggests a market that’s finally starting to stretch its legs.

After dominating the conversation for years, big tech and pure-play AI names took a small step back last week. Stepping into the spotlight instead were cyclicals, materials, industrials, and AI-adjacent infrastructure — quietly, but convincingly.

This isn’t the AI trade breaking down. It looks more like the next phase of it — and historically, that’s a healthier setup.

What helped drive the shift:

A geopolitical wildcard: Early in the week, news of the U.S. capturing Venezuelan President Nicolás Maduro sent energy stocks higher and lifted oil prices.

A jobs data reality check: December payrolls pointed to a cooling labor market, but nothing alarming. That was enough to keep the soft-landing narrative intact without putting pressure on risk assets.

Rotation doing its thing: Data storage, nuclear energy, homebuilders, and defense stocks stood out, supported by AI infrastructure demand, mortgage policy chatter, and renewed defense spending discussions.

Under the surface, a few longer-term forces are at work. Earnings growth remains solid but is clearly slowing. Tech giants are pouring billions into AI infrastructure with payoffs that will take time to materialize. And after years of outperformance, fund managers are locking in profits from mega-caps and reallocating toward smaller names and cyclicals, where valuations look far more reasonable.

Narrow rallies tend to burn out. Broader ones usually last longer. For patient investors, some of the most interesting opportunities often emerge in the parts of the market that don’t make headlines. If this trend holds, 2026 could be the year diversification finally starts earning its keep again.

PRESENTED BY THE WALL STREET DREAM

Investing is Our Business.

Dream Picks is Your Advantage.

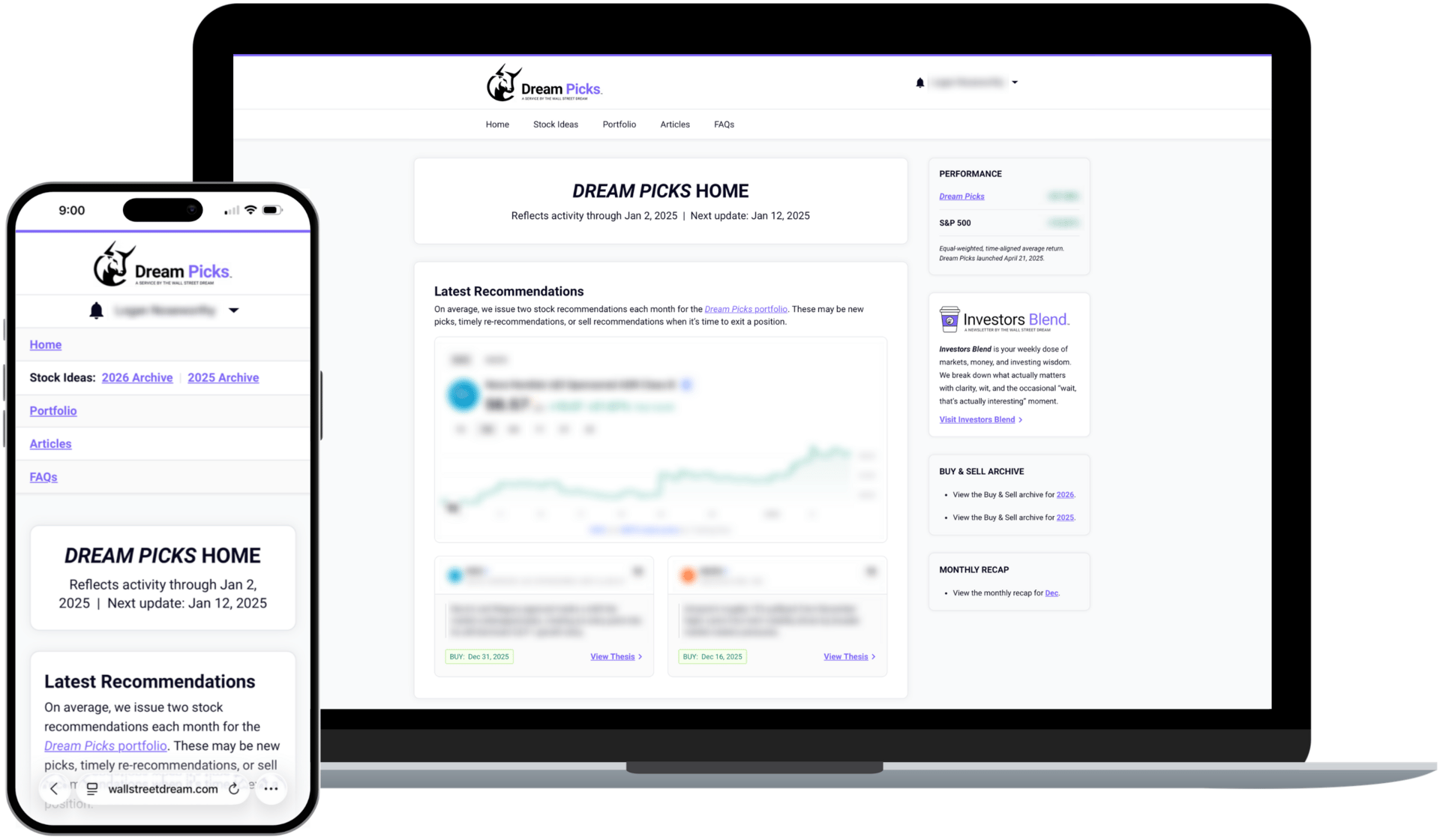

Stop chasing headlines and start investing with confidence. Dream Picks delivers clear, research-backed stock recommendations to help individual investors like you save time, eliminate guesswork, and build long-term wealth. We cut through the noise to deliver actionable insights, along with ongoing coverage that empowers you to invest smarter, now and into the future.

What You Get As a Member:

📈 Monthly Recommendations: Get, on average, two stock picks each month — each one backed by a clear, easy-to-follow investment thesis.

📚 Buy & Sell Archive: Explore all active stock recommendations, along with full access to every past Buy, Re-Recommendation, and Sell call — each with its original thesis.

📩 Weekly Email Updates: Receive a brief Monday-morning email notifying you when the Members Area is updated and whether any recommendations were issued.

🔒 Exclusive Members' Area: Access all stock picks, investment theses, and performance tracking in one simple, easy-to-navigate members’ area.

STOCKS

🟢 What’s up

Nuclear energy names (Vistra, Oklo): jumped on Meta-related data-center power deals.

Homebuilders (D.R. Horton, PulteGroup, Lennar): surged on talk of mortgage bond purchases aimed at lowering rates.

Intel: climbed on improved turnaround commentary and political tailwinds.

Defense stocks (e.g., Lockheed Martin): moved higher on renewed military spending momentum.

🔴 What’s down

Some large financials (including JPMorgan and Blackstone) pulled back amid rotation.

Overall downside remained limited in what was a broadly positive week.

NEWS

The U.S. captures Venezuelan President Nicolás Maduro; energy stocks rally on long-term oil optimism.

December jobs report shows continued labor-market cooling, but no clear recession signals.

AI infrastructure heats up as data storage and nuclear names rally on CES buzz and corporate deals.

Mortgage bond buying and defense spending discussions lift related sectors.

CALENDAR

It’s a lighter week on the data front, but keep an eye on Fed speakers, early earnings chatter, and any tariff or geopolitical developments. Historically, January leans positive — and if this broadening trend holds, momentum could carry forward.

ANSWER + WORD & WISDOM OF THE WEEK

Answer: Historically, the S&P 500 averages about +0.9% to +1% in January. Years that start with a positive January have tended to produce stronger full-year returns — roughly 16% on average versus about 3% in years with a negative January. Nothing’s guaranteed, but history suggests momentum often builds.

Word of the Week: “Reversion” (noun): The act of returning to a prior state or level — in markets, often referring to the idea that prices and valuations eventually move back toward their long-term averages.

Example: “Every bull market forgets about mean reversion — until it doesn’t.”

Investing Wisdom: Markets don’t reward excitement — they reward endurance. When leadership spreads out, the smarter move is often staying invested and diversified, not chasing whatever just had its moment.

Questions or feedback? Just hit reply — we’d love to hear from you.

Cheers,

☕️ The Investors Blend Team

Written by the Investors Blend team. AI tools were used to assist with editing and refinement, but all insights, perspectives, and opinions are entirely our own.