Today is January 19, 2026. After last week’s strong opener, markets hit the brakes and slipped into a choppy, headline-driven pullback. Losses across the major indexes were modest, with no real damage done. It felt more like a pause as investors digested mixed bank earnings, fresh policy concerns, and geopolitical noise.

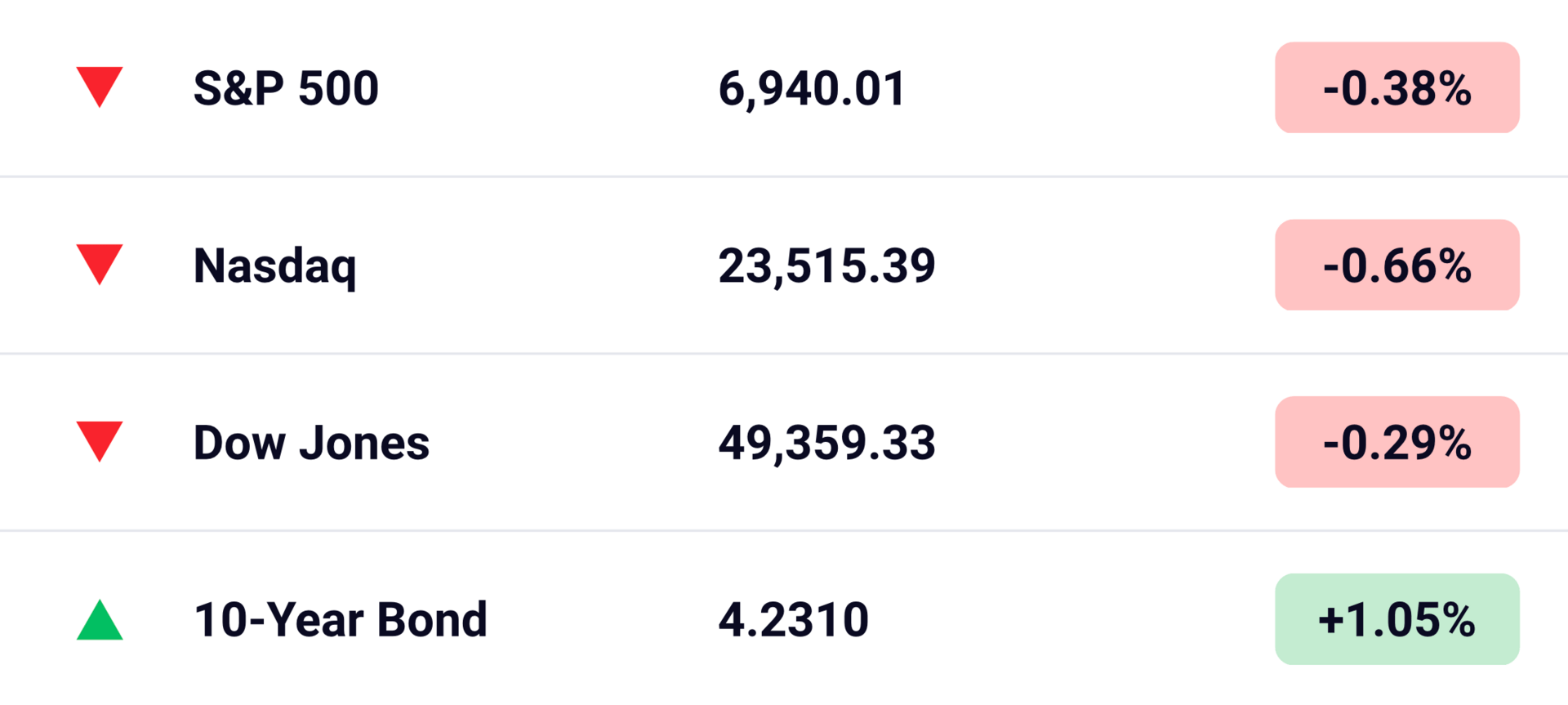

MARKETS AT A GLANCE

*As of market close January 16, 2026.

S&P 500: Down 0.38% for the week, closing at 6,940.01 after pulling back from recent highs.

Nasdaq Composite: Down 0.66%, finishing around 23,515.39.

Dow Jones Industrial Average: Down 0.29%, ending the week at 49,359.33.

10-Year Treasury Yield: Rose to 4.2310, hitting four-month highs amid pressure from strong economic data and reduced expectations for Fed rate cuts.

All three major indexes posted modest weekly declines during a volatile, headline-heavy stretch. Earnings reactions, rising Treasury yields (now at four-month highs around 4.23%), and geopolitical developments drove most of the movement. Importantly, downside pressure remained contained. There was no broad panic as markets absorbed the first wave of bank earnings and shifting macro signals.

FEATURED STORY

Earnings Volatility & Headline Risks Dominate a Choppy Week

The first full week of bank earnings brought mixed results and sharp moves, highlighting how quickly sentiment can shift on guidance, macro noise, and policy surprises.

Markets paused after the prior week's strength. Indices gave back ground amid yield pressure on growth names and fresh geopolitical developments. Key highlights:

Bank earnings disappointment as many big names reported results that fell short or faced selling despite some beats, with concerns over expenses, deal delays, and potential credit card rate caps adding pressure.

Energy and power stocks tanked Friday following reports of a Trump-backed plan to shake up the grid by accelerating new power plant builds and long-term AI data-center contracts via emergency auctions. While this could benefit future builders, it sparked fears of electricity rate caps or disadvantages for existing independent producers. Constellation Energy (CEG) plunged sharply, posting a double-digit decline as investors priced in short-term uncertainty.

Software names were hit hard as AI disruption fears resurfaced. Stocks like Constellation Software (CSU), Adobe (ADBE), Salesforce (CRM), and Duolingo (DUOL) faced pressure amid worries that generative AI could commoditize traditional software, erode seat-based pricing models, and shift value elsewhere. The irony is that many of these businesses are still growing solidly. Revenue beats and guidance remain intact, but the market appears to be pricing in long-term threats faster than near-term monetization progress.

Trump threatened escalating tariffs, starting at 10% on February 1 and rising to 25% on June 1, on eight European allied nations if they continue opposing U.S. demands to purchase Greenland. The countries named include Denmark, Norway, Sweden, France, Germany, the UK, the Netherlands, and Finland. European leaders called the move unacceptable and a threat to trans-Atlantic ties. Markets digested the news quietly on Friday, but with U.S. trading closed Monday for Martin Luther King Jr. Day, Tuesday’s open (January 20) could see a negative reaction, especially if European markets or futures signal escalation. Tariffs on close allies are rare and could ripple into trade-sensitive sectors.

If these headline risks stay contained, patient investors may find opportunities amid the noise. Earnings from big tech and infrastructure names next week should provide the next clues.

PRESENTED BY THE WALL STREET DREAM

Investing is Our Business.

Dream Picks is Your Advantage.

Stop chasing headlines and start investing with confidence. Dream Picks delivers clear, research-backed stock recommendations to help individual investors like you save time, eliminate guesswork, and build long-term wealth. We cut through the noise to deliver actionable insights, along with ongoing coverage that empowers you to invest smarter, now and into the future.

What You Get As a Member:

📈 Monthly Recommendations: Get, on average, two stock picks each month — each one backed by a clear, easy-to-follow investment thesis.

📚 Buy & Sell Archive: Explore all active stock recommendations, along with full access to every past Buy, Re-Recommendation, and Sell call — each with its original thesis.

📩 Weekly Email Updates: Receive a brief Monday-morning email notifying you when the Members Area is updated and whether any recommendations were issued.

🔒 Exclusive Members' Area: Access all stock picks, investment theses, and performance tracking in one simple, easy-to-navigate members’ area.

STOCKS

🟢 What’s up

Novo Nordisk (NVO): Up 5.99% this week after positive news on oral Wegovy prescriptions, showing strong early demand signals, and UK approval of a higher 7.2mg dose for Wegovy, boosting confidence in the obesity franchise’s growth potential.

Advanced Micro Devices (AMD): Rallied 14.11% amid broader semiconductor strength, driven by Taiwan Semiconductor’s strong results and capex guidance, which signaled robust AI buildout demand, along with continued optimism around AMD’s data-center and AI accelerator positioning.

Taiwan Semiconductor Manufacturing Company (TSM): Up 5.80% after an earnings beat, strong advanced-node demand, and margin expansion pointing to continued AI momentum.

Sandisk Corporation (SNDK): Up 9.59% amid surging AI-driven demand for NAND flash and data storage solutions, supported by tight supply, rising enterprise SSD prices, and growing optimism around memory needs for AI workloads.

Micron Technology (MU): Up 5.12% on continued strength in memory chips, driven by high-bandwidth memory demand for AI training and inference, positive analyst revisions, and a broader semiconductor rally tied to data-center expansion.

🔴 What’s down

Energy and power: Sharp Friday sell-off in names like Constellation Energy (CEG) and Vistra Corp (VST) on fears tied to the proposed grid overhaul

Software: Heavy pressure on Constellation Software (CSU), Adobe (ADBE), Salesforce (CRM), and Duolingo (DUOL) as AI commoditization concerns resurfaced, despite underlying growth.

Banks broadly: Shares of Bank of America (BAC), Wells Fargo (WFC), and Citigroup (C) each fell about 5% after reporting quarterly results. JPMorgan Chase (JPM) and Goldman Sachs (GS) also moved lower amid mixed earnings reactions, expense concerns, and rate-cap chatter.

Netflix (NFLX): Down 1.63% as its recent downward trend continues.

PayPal (PYPL): Down 1.36%, continuing to earn its “PainPaL” nickname on fintwit.

Robinhood Markets (HOOD): Down 5.66% after a delay in crypto legislation rattled investors.

Microsoft (MSFT): Down 4.05% as valuation concerns grew alongside heavy AI spending.

NEWS

Earnings season accelerates with mixed bank results; more big tech and infrastructure reports arrive next week.

Trump’s energy grid push accelerates new AI-related builds but sparks rate-cap fears, sending energy stocks lower Friday.

Software stocks pressured by renewed fears of AI-driven commoditization of traditional tools.

Trump threatens tariffs on European allies over Greenland opposition, raising the risk of post-holiday volatility.

U.S. markets closed Monday in observance of Martin Luther King Jr. Day; trading resumes Tuesday, January 20.

CALENDAR

No trading on Monday due to the Martin Luther King Jr. Day holiday. Markets reopen Tuesday with earnings accelerating across tech, banks, and industrials, alongside Fed speakers and any fallout from tariff or geopolitical developments. Keep an eye on Treasury yields and policy headlines.

WORD & INVESTING WISDOM OF THE WEEK

Word of the Week: Reflexivity (noun)

The idea that investor beliefs can influence prices, and those price movements can then reinforce the original beliefs.

Example: Rising prices can fuel optimism, attracting more buyers and pushing prices higher, until the cycle eventually reverses.

Investing Wisdom:

Most of the time, investing feels unsatisfying. You do the work, form a view, and then the market spends weeks or even months disagreeing with you. That is usually the point where people start tinkering, second-guessing, and undoing good decisions for bad reasons. Being able to sit through that stretch without turning every doubt into an action is a bigger edge than most strategies.

Questions or feedback? Just hit reply — we’d love to hear from you.

Cheers,

☕️ The Investors Blend Team

Written by the Investors Blend team. AI tools were used to assist with editing and refinement, but all insights, perspectives, and opinions are entirely our own.